Invest Easy

Invest Now.

Strategy

At Brightstone Ventures, we firmly believe that the core of a successful deal lies in the hands of its operators. With this understanding, we've assembled a skilled team that meticulously identifies promising multi-family properties located in markets primed for growth. While we emphasize strategic planning and foresight, we're also acutely aware of the industry's unpredictability and are well-prepared to manage any unforeseen challenges that arise.

We acquire top-tier multi-family investments in the Southeast USA, employing strategies that enhance value and produce steady income. By tapping into off-market deals via our trusted network of brokers and sellers, we effectively mitigate risks. Our comprehensive management approach allows us to optimize returns across the entire investment journey. By being deliberate in our methods, we aim to foster lasting value in dynamic communities, furthering economic progress and enriching opportunities for our tenants.

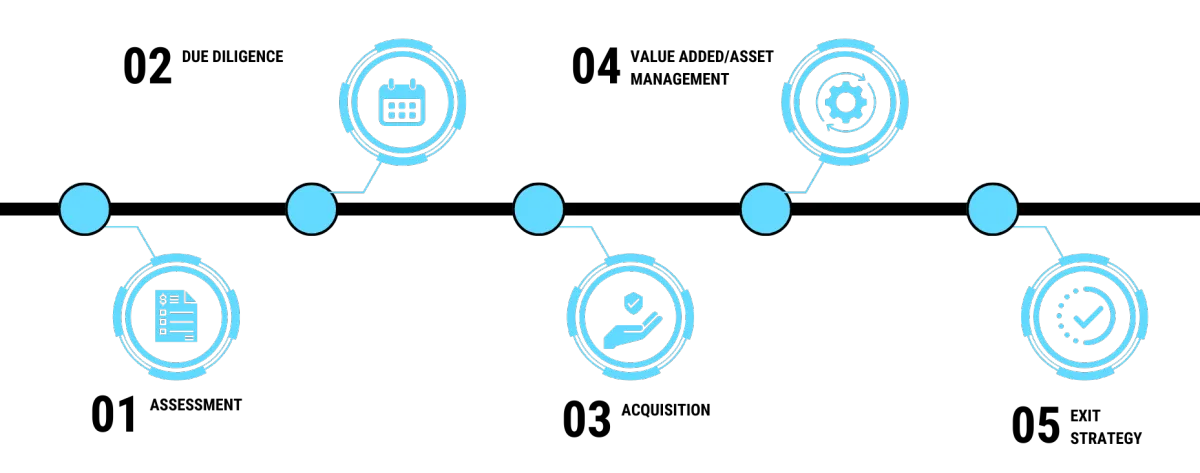

Our Investment Process

How it Works

1. Purchase

We purchase large multifamily properties with a very specific set of criteria. We focus on finding cash flowing assets with value add potential that will maximize our investors returns.

2. Manage

We hire best in class, local property management teams to increase income and decrease expenses, while providing an exceptional experience for our tenants.

3. Distribute

Investors share in the equity growth of the asset while also receiving regular cash flow distributions.

$55MM+

Assets Under Management

60+

Combined Years of Experience

486+

Total Units Owned

PORTFOLIO

Funded Projects

Property: The Boulevard

Market: Milledgeville, GA

Submarket: Georgia College

Bed Count: 126

Vintage: 2018

Asset Class: Class A

Purchase Price: $12,850,000

Occupancy: 100%

Property: East Main Quarters

Market: Mufressboro, TN

Submarket: Middle TN State

Bed Count: 252

Vintage: 2016

Asset Class: Class A

Purchase Price: $21,500,000

Occupancy: 98%

Property: The Mill District

Market: Athens, GA

Submarket: University of Georgia

Bed Count: 108

Vintage: 2022

Asset Class: Class A

Purchase Price: $21,100,000

Occupancy: 100%

Upcoming Projects

MULTIFAMILY APARTMENTS

STUDENT HOUSING

CLASS A OR B

SOUTHEAST UNITED STATES

COMMERCIAL REAL ESTATE

FOR ACCREDITED INVESTORS

"Exciting Developments on the Horizon!

We are committed to expanding our portfolio of high-quality multifamily apartments across the Southeast US, with a special focus on student housing. Stay tuned for updates on our upcoming projects that will provide modern, comfortable, and convenient living spaces for students and residents alike."

Why Real Estate?

Real estate stands as a resilient investment option due to its tangible nature, offering a physical asset that often appreciates over time. Consistent rental income provides investors with a steady cash flow, and the sector's tax advantages can enhance overall returns. Additionally, real estate can serve as an effective hedge against inflation, safeguarding an investor's capital.

Tangible Asset:

Real estate provides a physical asset that retains inherent value, offering a sense of security against market fluctuations.

Steady Appreciation:

Historical data indicates properties typically appreciate over time, resulting in both capital gains and consistent rental income.

Tax Advantages:

Benefits such as depreciation allowances can enhance the overall return on investment.

Portfolio Diversification:

Adding real estate to an investment mix can reduce volatility and potentially stabilize overall returns, complementing stock investments.

Our Team

Gian Franco Saglimbeni

With more than 18 years of business management experience, Gian Franco has spent the last decade managing more than 250 properties. He also launched his own firm in 2015 and has purchased, remodeled, and sold a $10 million portfolio composed of more than 80 properties. Gian Franco's extensive experience, combined with that of his two co-founders, has made Brightstone Ventures an impressive newcomer to the South Florida real estate scene.

Judith Fernandez

Judith's degrees in marketing, interior design, and architecture—along with her 20 years of experience—have given her a unique and valuable set of real estate management and development skills. Judith has led and managed multiple start-ups to unprecedented growth, co-founded the Fernandez Ugarte Group, coached and mentored agents and customers, and helped countless clients identify the best opportunities to satisfy all of their real estate and commercial investment needs.

Michael Ugarte

Over a 23-year career in real estate, South Florida industry leader Michael Ugarte has had a direct stake in the acquisition, development, and disposition of more than $415 million of commercial and residential real estate properties. Michael is also a co-founder of the Fernandez Ugarte Group, a top-producing real estate team that works closely with investors, builders, and developers to locate and revitalize investment opportunities.

Call 786-477-2085

Email: invest@brightstoneventures.com

Site: www.brightstoneventures.com